고정 헤더 영역

상세 컨텐츠

본문

Microsoft starts selling its Copilot A.I. tool for email and documents

CEO Satya Nadella made a surprise appearance at OpenAI’s developer conference on Monday with a message: Come build with us.

“Our job No. 1 is to build the best system, so that you can build the best models and then make that all available to developers,” Nadella told OpenAI CEO Sam Altman, on stage at DevDay in San Francisco.

Microsoft, which has reportedly invested $13 billion in OpenAI, wants to lure more developers to use its Azure cloud infrastructure for computing and storage, rather than choosing competitive offerings from Amazon

Web Services and Google Cloud. Azure has become Microsoft’s key growth engine in recent years and has helped revive the company’s brand among developers.

Around 900 people attended OpenAI’s first in-person event, a company spokesperson said. OpenAI is the creator of ChatGPT, the artificial intelligence-powered chatbot that went viral late last year and sparked a rush of investment into the generative AI space. The Wall Street Journal reported in September that OpenAI is in talks with investors about a share sale that would value the company at between $80 billion and $90 billion.

Microsoft boasts an exclusive license on OpenAI’s GPT-4 large language model that can generate human-like prose in response to a few words of text. Microsoft is introducing a variety of products that employ GPT-4, including an AI add-on for its Office productivity app subscriptions and an assistant in Windows 11.

At the show, OpenAI announced a more powerful GPT-4 Turbo model and said it would let people make custom versions of the ChatGPT chatbot. The company also said it would reduce fees that developers pay for its software. Developers can choose to buy OpenAI’s programming tools directly or through Microsoft. In both cases, Azure is the host.

Developers who are building on top of OpenAI can look to the Azure Marketplace to “get to market rapidly,” Nadella said.

It’s Nadella’s latest strategy to attract wide swaths of developers to Azure. In 2018, Microsoft spent $7.5 billion to buy GitHub, whose software helps companies store and share their code in repositories. Microsoft will provide the enterprise version of GitHub Copilot, which helps developers complete lines of source code, to all conference attendees, Nadella said.

(Following publication of this story, a GitHub spokesperson said Nadella misspoke, and that the company will be providing access to GitHub Enterprise, not Copilot, to attendees.)

Microsoft is using its position as the backbone of OpenAI as a way to make Azure a more compelling place for developers to built AI products and services.

“Our mission is to empower every person and every organization on the planet to achieve more, and to me, ultimately, AI is only going to be useful if it truly does empower,” Nadella said.

Altman is doing his part to promote Microsoft, especially as the companies work toward a potential future of artificial general intelligence (AGI).

“I think we have the best partnership in tech,” Altman told Nadella onstage. “I’m excited for us to build AGI together.”

Regarding the business arrangement, Altman said, “We set up the relationship between the two of us so that we’re very happy when they succeed with a sale and they’re very happy when we succeed with a sale.”

Microsoft Stock Hits Record High. Why Its Next Move Might Be Lower.

stock reached a new all-time closing high—but there could be some hiccups ahead in the short term.

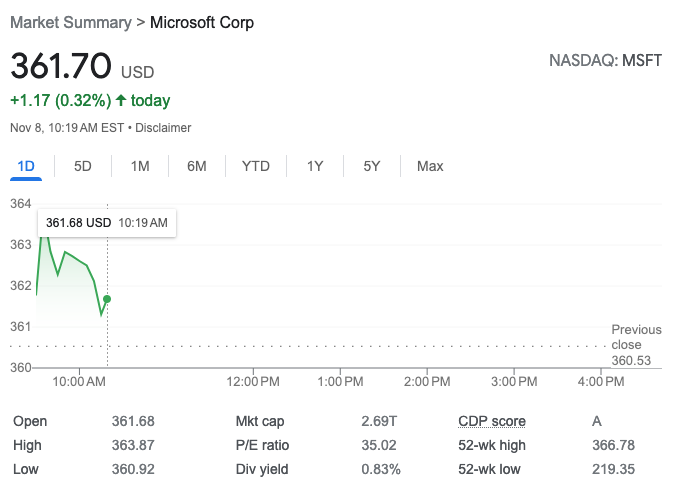

At first glance, the shares look unstoppable. Microsoft (ticker: MSFT) stock gained 1.1% Tuesday, to $360.53. That’s a new record closing high, surpassing the previous high of $359.49 reached on July 18. What’s more, Microsoft gained for eight consecutive days, its longest winning streak since Jan. 28, 2021.

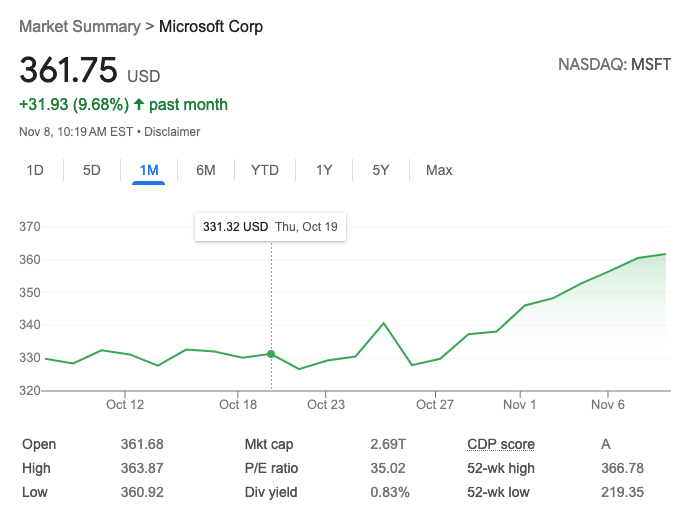

The stock has been helped by the company’s strong earnings and sales, which got a boost from the Azure cloud business. Microsoft stock rose 3.1% on the trading day following the report.

But it’s not just earnings. Microsoft was already outperforming its peers following tech weakness in August and September. Its stock has gained 15% since the end of September, outpacing Amazon.com

(AMZN), which has risen 12%, Meta Platforms (META), which has risen 6.5%, Nvidia NVDA

(AAPL), which is up 6%, Alphabet (GOOGL) which has ticked up 0.3%, and Tesla TSLA

(TSLA), which has dropped 13%.

마이크로소프트

MSFT

0.02% 주가가 사상 최고치를 경신했습니다.

하지만 단기적으로 약간의 변동이 일어날 수도 있습니다.

마이크로소프트 주식은 멈출 수 없어 보일 정도로 상승하고 있습니다

. 마이크로소프트 (티커: MSFT) 주가는

화요일 1.1% 상승한 360.53달러를 기록했습니다.

이는 7월 18일에 도달한 이전 최고치인

359.49달러를 뛰어넘는 새로운 기록으로 마감한 것입니다.

게다가 마이크로소프트는 8일 연속 상승하여 2021년 1월 28일 이래로 가장 긴 연속 상승세를 보였습니다.

주가는 애저 클라우드 사업에 힘을 받은 실적과 매출 호조에 힘입은 것으로

보고서 발표 후 거래일에 마이크로소프트 주가는 3.1% 상승했습니다.

그러나 이는 단지 수익만이 아닙니다.

마이크로소프트는 지난 8월과 9월의 기술 약세 이후

이미 동종 업체들을 능가하고 있었습니다.

마이크로소프트의 주가는 9월 말 이후 15% 상승하며 Amazon.com 을 앞질렀습니다

So why are we worried? It comes down to Microsoft’s 14-day relative strength index. The RSI, as it is commonly referred to, is a measure of a stock or index’s momentum or lack thereof. The closer it gets to 20 on the downside, the more oversold it is, while a score close to 80 signals a stock that is very overbought. Usually, a reading below 30 suggests a stock could be ready to bounce, while a score above 60 suggests a possible pullback. Microsoft’s RSI is currently 72.75, a sign that it is getting very overbought and that a pullback could be on its way.

그런데 왜 우리가 걱정을 해야 할까요?

바로 마이크로소프트사의 14일간 상대강도지수입니다.

흔히 말하는 RSI는 주식이나 지수의 모멘텀 혹은 부족을 측정하는 지표입니다.

20에 가까울수록 과매도가 증가하는 반면, 80에 가까운 지수는

매우 과매수된 종목을 의미합니다.

보통 30 미만이면 반등할 준비가 된 종목일 수 있음을,

60 이상이면 하락 가능성을 시사합니다.

마이크로소프트사의 RSI는 현재 72.75로, 이는 매우 과매수되고 있고

하락이 진행되고 있음을 보여주는 신호입니다.

That doesn’t mean Microsoft isn’t worth buying for its long-term potential. The company has a lot to recommend it, including a cloud business that should get a boost as ChatGPT, which held its developer conference yesterday, looks to expand. It just means that investors might get a better opportunity to pick up shares in the days ahead.

No matter what happens, though, it’s still Microsoft.

그렇다고 해서

마이크로소프트가 장기적인 잠재력 때문에 매수할 가치가 없는 것은 아닙니다.

어제 개발자 컨퍼런스를 개최한 ChatGPT가 확장할 것으로 보이기 때문에

활성화될 클라우드 사업을 포함하여 마이크로소프트는 이를 추천할 것이 많습니다.

단지

투자자들이 앞으로 며칠 안에 주식을 얻을 수 있는

더 좋은 기회를 얻을 수 있을지도 모른다는 것을 의미합니다.

하지만 무슨 일이 일어나든 그건 여전히 마이크로소프트입니다.

나스탁#러셀2000#닐#비둘기파#연준#굴스비#3년물#2년물#10년물#golden#수출#중국#

가계부채#연체율#신용카드#gdp#fomc#전쟁#리스크#정치#공화당#일일뉴스#투자#증시#주식#

테슬라#리비안#코스탁#인공지능#응찰률#한국경제#경제성장률#

한국경제성자율#총소생산성#생상성향상속도#숏커버링#숏포지션#

'미국주식 투자 정보' 카테고리의 다른 글

| Amazon cuts more than 180 jobs in gaming division, 아마존 주식 오를 것인가 ? (2) | 2023.11.28 |

|---|---|

| Stocks making the biggest moves after hours: Nvidia, Splunk, Autodesk, Guess and more (0) | 2023.11.28 |

| Palantir shares pop 20% after its third-quarter results beat estimates (1) | 2023.11.28 |

| Arm 과 NVIDIA 주가 의 상호 관계 (1) | 2023.11.28 |

| 미국의 전기차 제조업체 루시드가 중국 진출을 검토하고 있으며, 대중 시장 모델을 개발할 것을 확인했습니다. (0) | 2023.11.28 |